Airdrie residents will see their municipal taxes go up by $146.91 annually, as per the stipulations in the 2024 budget that city council passed on Monday afternoon. The tax increase will generate $5.2 million for the City.

Airdrie residents will see their municipal property taxes go up by $146.91 annually (approximately $12.24 per month), as per the stipulations in the 2024 budget that city council passed on Monday afternoon. (Graphic credit to the City of Airdrie)

Airdrie residents will see their municipal property taxes go up by $146.91 annually (approximately $12.24 per month), as per the stipulations in the 2024 budget that city council passed on Monday afternoon. (Graphic credit to the City of Airdrie) The overall operating budget for 2024 is approximately $207 million, including $153 million to deliver tax-supported city services, and $55 million to deliver water, sewer and waste management services.

Shannon Schindeler, Director of Corporate Services and Meghan Bigney, Manager of Finance with the City presented the final recommended budget to council before it was approved.

According to the presenters, the annual municipal tax increase equates to $12.24 per month for the average Airdrie household.

Airdrie residents will be paying more in municipal taxes - but they can see how that money is being spent. (Graphic credit to the City of Airdrie)

Airdrie residents will be paying more in municipal taxes - but they can see how that money is being spent. (Graphic credit to the City of Airdrie)"It is important to note here that we are talking only of the municipal portion of property taxes, which is approximately 67 per cent of the total tax bill. 32 per cent of total taxes collected, go to the province for education tax and 1 per cent is collected on behalf of Rockyview Foundation for low rental housing units for seniors," Bigney said.

The $12.24 per month is split between 55 per cent being allocated toward municipal services and the other 45 per cent towards capital investments.

A breakdown of where and what the municipal portion of the tax increase ($6.76) is funding, was presented to council as follows:

- Four new RCMP officers

- Four new firefighters

- Two lifeguards

- Increased service levels on all transit routes

- Increased service levels regarding anti-icing during winter road maintenance.

- A permanent Veterans Memorial

- Increased advocacy efforts at the provincial and federal levels of government

- Increased contributions to the tax Stabilization Fund - meant to spread the impact of opening Airdrie's new facilities over time; such as the multi-use facility and library, the fire hall and the new recreation center.

A breakdown of where and what the capital investments portion of the tax ($5.48) increase in funding, was presented to council as follows:

- Funds to lifecycle the city's existing $1.3 billion asset base and new capital assets such as Airdrie's existing splash park, portable skateboard park and basketball courts.

A medium business with an assessed value of $850,000 will see an annual municipal tax increase of $559 or $46 per month.

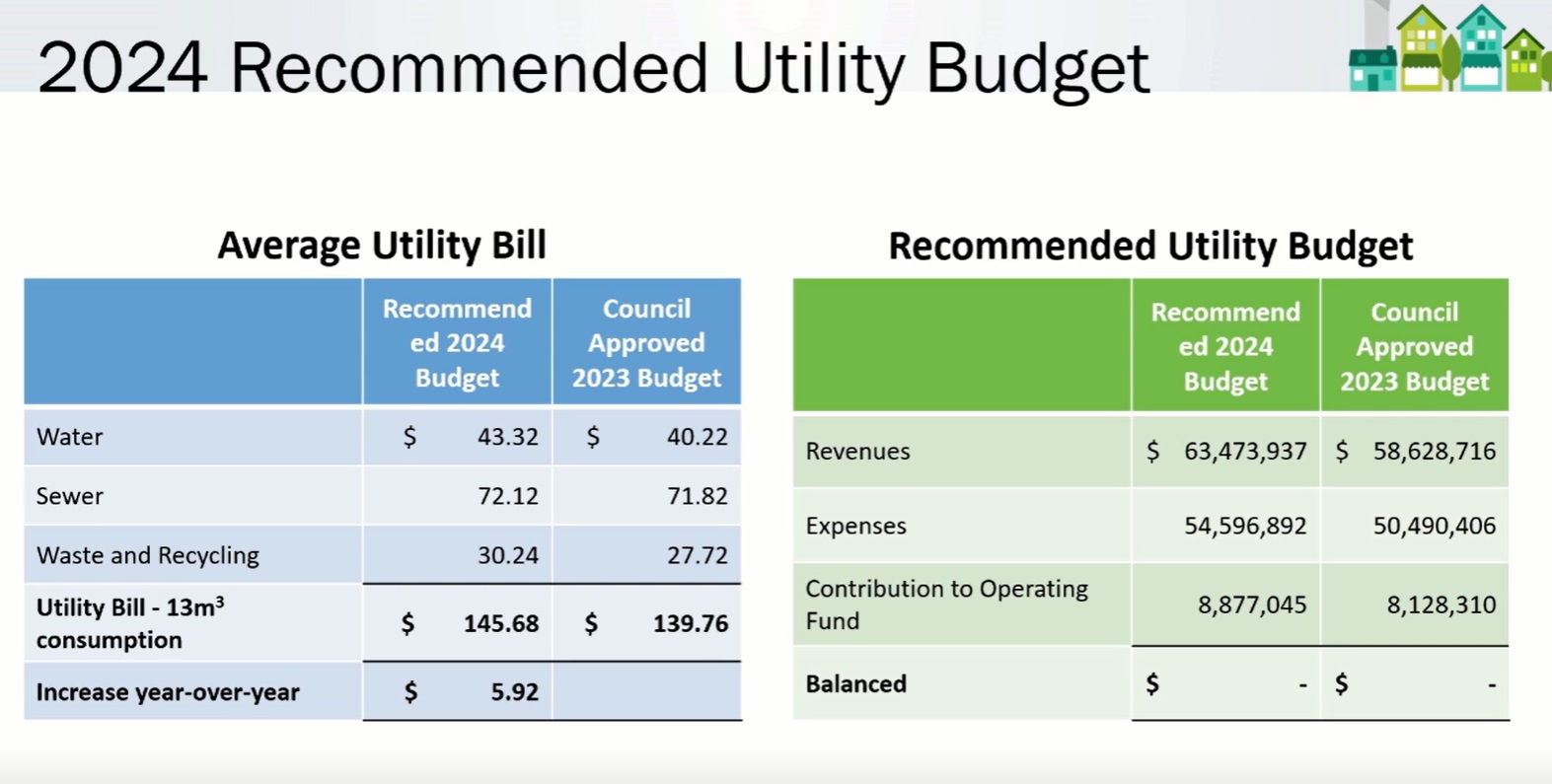

With a utility budget of $54.6 million required to operate water, sewer and waste services, the average bill will increase by $5.92 in 2024.

Council was also presented a breakdown of the utility budget for 2024. (Graphic credit to the City of Airdrie)

Council was also presented a breakdown of the utility budget for 2024. (Graphic credit to the City of Airdrie)"As a reminder, these increases are mainly due to the rising water and sewer costs coming from the City of Calgary, increased sewer pre-treatment, chemical costs, and increased fees seen in waste and recycling collection and disposal."

The 2024 Capital budget is $131.6 million, and includes major projects such as the Highland Park Fire Station, the start of the Southwest Regional Recreation Center, the Ed Eggerer Athletic Park artificial turf field, Ron Ebbessen arena interior upgrades, which include the addition of a mini-rink, the financial enterprise software as well as various roads and utility projects.

Following budget deliberations, a $6 million deficit existed; and because municipalities must have balanced budgets, several strategies were employed to lessen the pressure on taxpayers. It was recommended that $838,000 be used from the General Operating Reserve to fund one-time expenditures in 2024.

"Funds will be directed to the General Operating Reserve at the end of this fiscal year using a portion of the projected 2023 surplus. This leaves a need to raise an additional $5.2 million in tax revenue; of that, $2.3 million relates to capital investments with the remaining $2.9 million to cover municipal services. There was $3 million of growth revenue projected for 2024 that did help close the gap to the $5.2 million," Schindeler explained.

Before council passed the budget on Monday, several deliberations on the budget took place via the Council Budget Committee (CBC) earlier this month.

Send your news tips, story ideas, pictures, and videos to news@discoverairdrie.com. You can also message and follow us on Twitter: @AIR1061FM

In response to Canada's Online News Act and Meta (Facebook and Instagram) removing access to local news from their platforms, DiscoverAirdrie encourages you to get your news directly from your trusted source by bookmarking this page and downloading the DiscoverAirdrie app. You can scan the QR code to download it.